Blunderous Barnacle Failed to Report Income From Outthink Energy Consulting Firm to FPPC While Suspended With CA Secretary of State

The Building Decarbonization Coalition's Form 990 indicates that Petaluma Councilman Barnacle's Outthink, LLC received over $100k as a paid consultant and a salary of $137k for the 2022 fiscal year

Petaluma Councilman Brian Barnacle is seeking re-election but has not been transparent with his constituents. While serving on the Council, he has simultaneously been employed as the Director of Strategy & Development, Building Decarbonization Coalition and as a Consultant for Outthink LLC, a consulting firm for carbon footprint reduction.

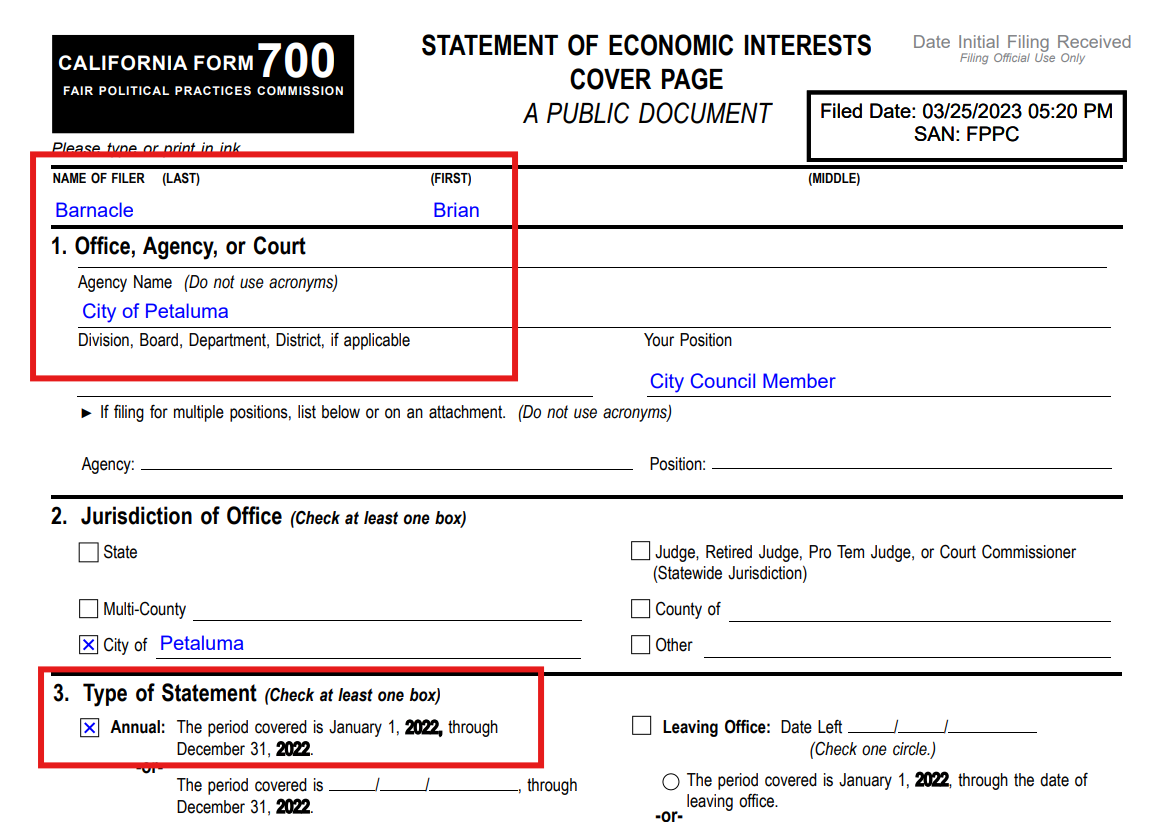

For the 2022 reporting period, Councilman Barnacle failed to report his income from Outthink, LLC to the Fair Political Practices Commission and his clients, which generated over $10k in revenue. As Mr. Barnacle has served on numerous local agencies, he has voted on matters recommending mandatory electrification with the ultimate goal of zero emissions. This presents a plausible conflict of interest because clients were not publicly disclosed as required under California State law.

The Fair Political Practices Commission (FPPC) is a five-member independent, non-partisan commission that has primary responsibility for the impartial and effective administration of the Political Reform Act. The Act regulates campaign financing, conflicts of interest, lobbying, and governmental ethics. The Commission’s objectives are to ensure that public officials act fairly and unbiasedly in the governmental decision-making process, promote transparency in government, and foster public trust in the political system.

Every elected official and public employee who makes or influences governmental decisions is required to submit a Statement of Economic Interest, also known as Form 700. The Form 700 provides transparency and ensures accountability in two ways:

It provides necessary information to the public about an official’s personal financial interests to ensure that officials are making decisions in the best interest of the public and not enhancing their personal finances.

It serves as a reminder to the public official of potential conflicts of interest so the official can abstain from making or participating in governmental decisions that are deemed conflicts of interest.

Officials listed in Government Code Section 87200 (e.g., boards of supervisors, city council members, planning commissioners, elected state officials, etc.) must report investments, business positions, and sources of income, including receipt of gifts, loans, and travel payments, from sources located in or doing business in their agency’s jurisdiction. All interests in real property within the agency’s jurisdiction must also be reported. For local officials, real property located within two miles of the boundaries of the jurisdiction or any real property that the agency has an interest in is deemed to be “within the jurisdiction.”

Councilman Barnacle’s 2022 Form 700 indicated that he only received income from Building Decarbonization Coalition and his spouse received income from Vanda Floral Design.

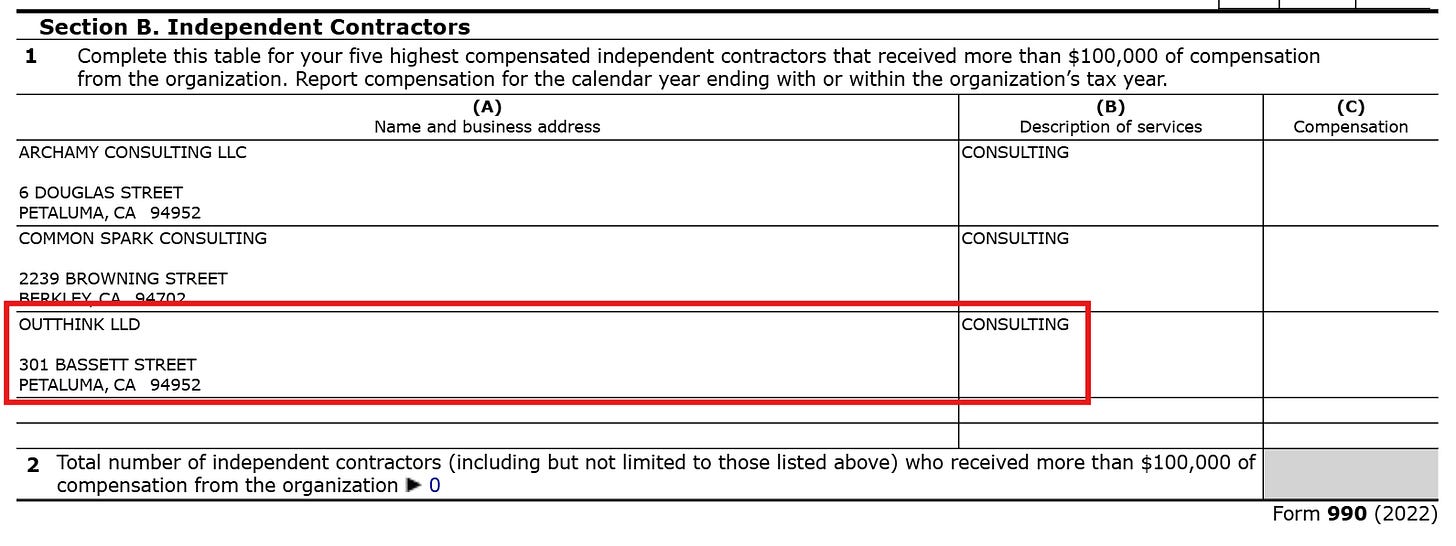

Building Decarbonization Coalition’s (BDC) Form 990 for the January 1, 2022 - December 31, 2022, fiscal period itemized paid staff, as well as multiple independent contractors who received more than $100k.

Although it was spelled incorrectly, BDC itemized Outthink, ‘LLD’ as an independent contractor which received more than $100k during the fiscal period.

The California Secretary of State’s business database indicates that as of November 8, 2019, Outthink, LLC was registered to Mr. Brian Barnacle at 201 H Street Unit D, Petaluma, CA.

However, the business was placed in ‘suspended’ status as of December 16, 2022.

Per the Franchise Tax Board:

When your business has been suspended or forfeited, it is not in good standing and loses its rights, powers, and privileges to do business in California.

To revive your business and be in good standing, you must:

File all past due tax returns

Pay all past due tax balances

File a revivor request form

The Form 990 indicated that Outthink was located at 301 Bassett St. After a quick reverse search in Google, Mr. Barnacle appears to be affiliated directly with the aforementioned address.

In addition to the consulting fees, Mr. Barnacle received a salary of $137,936 from Building Decarbonization Coalition and $14,483 from related organizations.

As Councilman Barnacle advocates to move forward with projects that have outraged local taxpayers, is he concerned with saving our environment, or scheming for new consulting opportunities?

“People never lie so much as after a hunt, during a war or before an election.”

-Otto von Bismarck

Hi Ms. Flores. Since you are into investigating finances, you may be interested in knowing that I have caught the Franchise Tax Board running 8 schemes to overcharge taxpayers. This was all documented in San Diego Superior Court records. 3 of the schemes are embezzling and racketeering, where the FTB doesn't apply estimated tax payments to your account right away. They temporarily put the money in "suspense" and the money temporarily vanishes from FTB's books. Due to egregious accounting irregularities documented in my court case with these "suspense" payments, I am certain it is an off the books spending account. I'm working on getting more details about who controls that money and what it is used for. Details here: https://gwsandiego.net/blog/?p=611